|

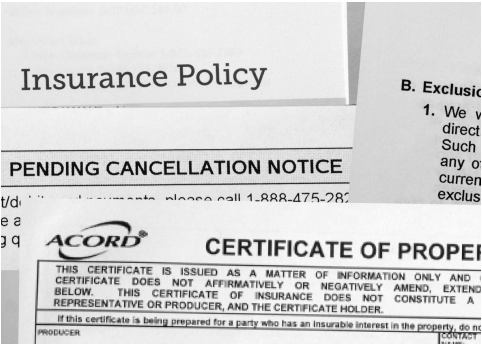

Insurance Bad Faith

My insurance litigation background includes analyzing and litigating claims under an array of insurance policies including: - Homeowners - Commercial General Liability (CGL) - Commercial Property - Directors and Officers Liability (D&O) - Errors and omissions (E&O)/Malpractice - Automobile (also see the Auto Law Page) |

Almost every case is an insurance case.

If someone hurts you or your property forcing you to sue, an insurance company picks the opposing lawyer, pays that lawyer's legal bills, and largely calls the shots for the other party. This is as true in a minor auto collision case as it is in cases of serious medical negligence. As the injured party, you are on your own.

When your own insurer acts in bad faith and you must sue it directly, be ready for the fight of your life. I know. I represented them in bad faith cases for over a decade.

Now, I am here to help you.

If someone hurts you or your property forcing you to sue, an insurance company picks the opposing lawyer, pays that lawyer's legal bills, and largely calls the shots for the other party. This is as true in a minor auto collision case as it is in cases of serious medical negligence. As the injured party, you are on your own.

When your own insurer acts in bad faith and you must sue it directly, be ready for the fight of your life. I know. I represented them in bad faith cases for over a decade.

Now, I am here to help you.

A Real Insurance Lawyer

Many lawyers today advertise they handle “insurance bad faith” claims. Few have much experience with such cases. If you are in a fight with an insurance company, make sure you find a lawyer who knows what he or she is doing. Even if you do not work with me, I can help point you to lawyers who know the practice and help you avoid those that do not.

I have assembled information on my website to help familiarize you with some important issues related to bad faith claims and other litigation matters. This information is no substitute for talking to an attorney directly and is not meant as direct legal advice to anyone.

The Insurance Reality

Insurance companies exist to make money, not to pay claims. Even so-called “mutual” insurance companies turn quickly into massive moneymakers dominated by executives working to maximize their pay and bonuses, as opposed to providing benefits to the policyholders who technically own the company. Insurance companies disguise their true nature through masterful advertising campaigns suggesting they are on your friends and advocates, employ only highly-trained adjusters, and are available at all times.

Just think of your favorite advertisements and the biggest Super Bowl ads. How many are for insurance companies? How much can that gecko save you? You know. “Flo,” the Progressive Insurance’s hip spokeswoman, was a stage character created by a starving young comedian. Seeing the marketing potential for younger insurance purchasers, Progressive bought the act and made it its own. (If you think someone like Flo will handle your Progressive claim, see my “Insurance Nightmares” page.) What about Farmers? You can sing the song (“We are Farmers . . .”), and they have a university! Right. Do not be duped by insurance companies’ marketing. They are not “on your side,” to quote yet another ad campaign you likely recognize.

Bad Faith: You’re lucky to be in Washington

Washington law holds insurance companies must deal fairly and honestly with their insureds. In fact, our state an insurance company is supposed to give equal consideration to its own interests and the interests of its insured. Insurance companies violating these and other principles act in bad faith.

Washington also has one of most consumer-focused insurance commissioners in the nation. The Office of the Insurance Commissioner establishes rules for the fair handing of claims, including timeframes for claim investigation and a requirement that the insurance company fully inform the insured of all coverages under the policy potentially applicable to each claim. Policyholders in Washington possess an array of rights and causes of action when their insurance companies act in bad faith, breach their contracts (insurance policies), and violate claim-handling rules. Does this make insurance companies more considerate toward their Washington insureds? No.

Insurance companies make more money, even in states with strong consumer protection laws, by avoiding responsibility than by acting as the law and their policies require. They know most people accept an insurance company’s low-ball estimates and won’t bother complaining when directed the insurance company’s favored repair centers or contractors for second-rate work. Even when an insured pushes back, the insured is met with the insurance companies’ mantra: delay, deny, deceive. When an insured sues, the insurance company typically mounts a major fight, preferring to pay lawyers over their insureds’ claims.

Thankfully, Washington law permits a range of options for recovering against an insurance company for the harm it causes depending on the facts of the case, including:

- Coverage by estoppel (requiring the insurance company to cover portions of claims that would otherwise fall outside of the policy’s coverage due to the company’s wrongdoing)

- Recovery of attorney fees and costs

- Treble damages (getting your damages multiplied up to three times in some cases)

If an insurance company has denied, underpaid, or poorly handled your claim, let me know.

The topics below and on my Civil Litigation page provide more helpful information about insurance disputes and litigation matters.

IF YOU ARE SUED and an insurance company is paying for your defense, be sure to read the “Independent Counsel” information page, the link is below.

Many lawyers today advertise they handle “insurance bad faith” claims. Few have much experience with such cases. If you are in a fight with an insurance company, make sure you find a lawyer who knows what he or she is doing. Even if you do not work with me, I can help point you to lawyers who know the practice and help you avoid those that do not.

I have assembled information on my website to help familiarize you with some important issues related to bad faith claims and other litigation matters. This information is no substitute for talking to an attorney directly and is not meant as direct legal advice to anyone.

The Insurance Reality

Insurance companies exist to make money, not to pay claims. Even so-called “mutual” insurance companies turn quickly into massive moneymakers dominated by executives working to maximize their pay and bonuses, as opposed to providing benefits to the policyholders who technically own the company. Insurance companies disguise their true nature through masterful advertising campaigns suggesting they are on your friends and advocates, employ only highly-trained adjusters, and are available at all times.

Just think of your favorite advertisements and the biggest Super Bowl ads. How many are for insurance companies? How much can that gecko save you? You know. “Flo,” the Progressive Insurance’s hip spokeswoman, was a stage character created by a starving young comedian. Seeing the marketing potential for younger insurance purchasers, Progressive bought the act and made it its own. (If you think someone like Flo will handle your Progressive claim, see my “Insurance Nightmares” page.) What about Farmers? You can sing the song (“We are Farmers . . .”), and they have a university! Right. Do not be duped by insurance companies’ marketing. They are not “on your side,” to quote yet another ad campaign you likely recognize.

Bad Faith: You’re lucky to be in Washington

Washington law holds insurance companies must deal fairly and honestly with their insureds. In fact, our state an insurance company is supposed to give equal consideration to its own interests and the interests of its insured. Insurance companies violating these and other principles act in bad faith.

Washington also has one of most consumer-focused insurance commissioners in the nation. The Office of the Insurance Commissioner establishes rules for the fair handing of claims, including timeframes for claim investigation and a requirement that the insurance company fully inform the insured of all coverages under the policy potentially applicable to each claim. Policyholders in Washington possess an array of rights and causes of action when their insurance companies act in bad faith, breach their contracts (insurance policies), and violate claim-handling rules. Does this make insurance companies more considerate toward their Washington insureds? No.

Insurance companies make more money, even in states with strong consumer protection laws, by avoiding responsibility than by acting as the law and their policies require. They know most people accept an insurance company’s low-ball estimates and won’t bother complaining when directed the insurance company’s favored repair centers or contractors for second-rate work. Even when an insured pushes back, the insured is met with the insurance companies’ mantra: delay, deny, deceive. When an insured sues, the insurance company typically mounts a major fight, preferring to pay lawyers over their insureds’ claims.

Thankfully, Washington law permits a range of options for recovering against an insurance company for the harm it causes depending on the facts of the case, including:

- Coverage by estoppel (requiring the insurance company to cover portions of claims that would otherwise fall outside of the policy’s coverage due to the company’s wrongdoing)

- Recovery of attorney fees and costs

- Treble damages (getting your damages multiplied up to three times in some cases)

If an insurance company has denied, underpaid, or poorly handled your claim, let me know.

The topics below and on my Civil Litigation page provide more helpful information about insurance disputes and litigation matters.

IF YOU ARE SUED and an insurance company is paying for your defense, be sure to read the “Independent Counsel” information page, the link is below.

INDEPENDENT COUNSEL:

PROTECT YOURSELF

If

you are sued,

beware of your insurance defense lawyer.

beware of your insurance defense lawyer.